ACCBF a program of A Warriors Mission Inc a trusted 501(c)(3) charity

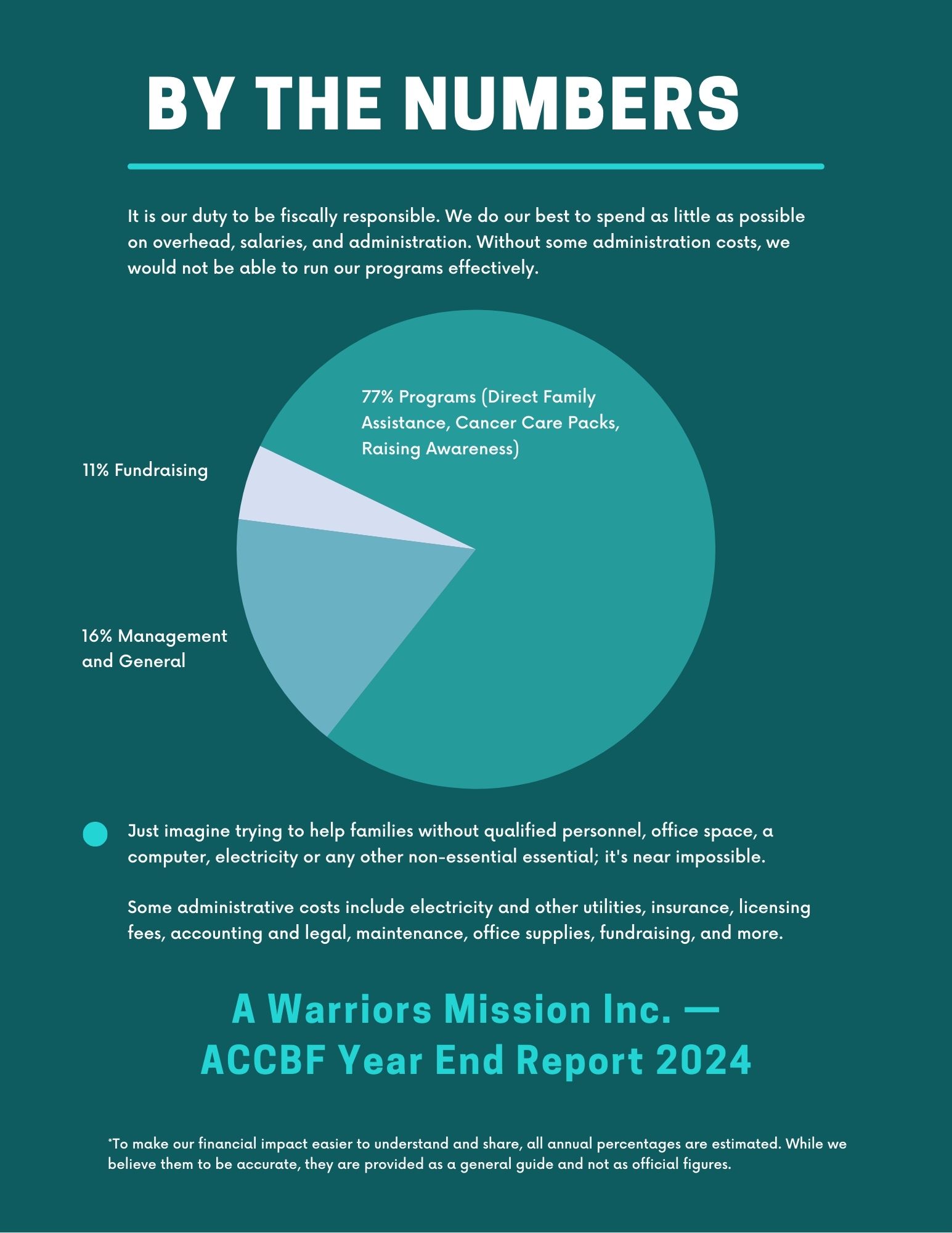

Expense Breakdown

Expense breakdown for the American Childrens Cancer Benevolence Fund. The chart on this page illustrates how donations to our organization are spent.

We do our best to spend as little as possible on overhead, and administration. Without some administration costs, we would not be able to effectively run our programs.

Let's talk a little about administration costs. Without these, most charities can not function.

Just imagine trying to help families without qualified personnel, office space, a computer, electricity or any other non-essential essential, it's near impossible.

Some examples of administrative costs are:

Rent - Office Space

Utilities

Insurances

Licensing Fees

Accounting and Legal

Facility Upkeep

Office Supplies

and more

Learn more:

American Childrens Cancer Benevolence Fund

administered by A Warriors Mission Inc, a trusted 501(c)(3) charitable organization

Any use of this site constitutes your agreement to the Disclaimers, Terms and Conditions and Policies linked below.

Privacy Policy Terms Of Use We Do Not Discriminate Disclaimer Affiliate Program Advertise With Us

© All rights reserved. A Warriors Mission Inc. Our mission is to help meet the needs of humankind without discrimination. Our programs and services are funded entirely by private donations, foundation grants, and corporate contributions. A Warriors Mission, Inc. is a trusted 501 (c)(3) tax exempt organization. Tax Id # 84-3175352.

Gifts to the organization are tax deductible to the extent provided by law. You can be assured that we will take all reasonable measures to honor requests by the donor, but please know we retain all control and authority over all contributed funds and have the authority to redistribute those donated funds in connection with our charitable and religious purposes. This church is a qualified section 501(c)(3) organization. All tithes, offerings, or donations of any kind are tax-deductible under section 170(c)(2). Making a donation constitutes your agreement to relinquish control in accordance with IRS regulation. This authority allows us to maintain our 501(c)(3) status. IRS rules require that the fair market value of any gift received in connection with a donation must be subtracted from the amount claimed for deduction. If you believe that an error has occurred in connection with your donation, contact us

We do not warrant that the information found here is complete, reliable, useful, or otherwise accurate. Always seek the advice of your physician or other qualified health provider with any questions you may have regarding a medical condition. Never disregard professional medical advice or delay in seeking it because of something you have read on this Website. Do not rely on the information presented for medical advice or other ACCBF programs.