ACCBF a program of A Warriors Mission Inc a trusted 501(c)(3) charity

Costs of Childhood Cancer

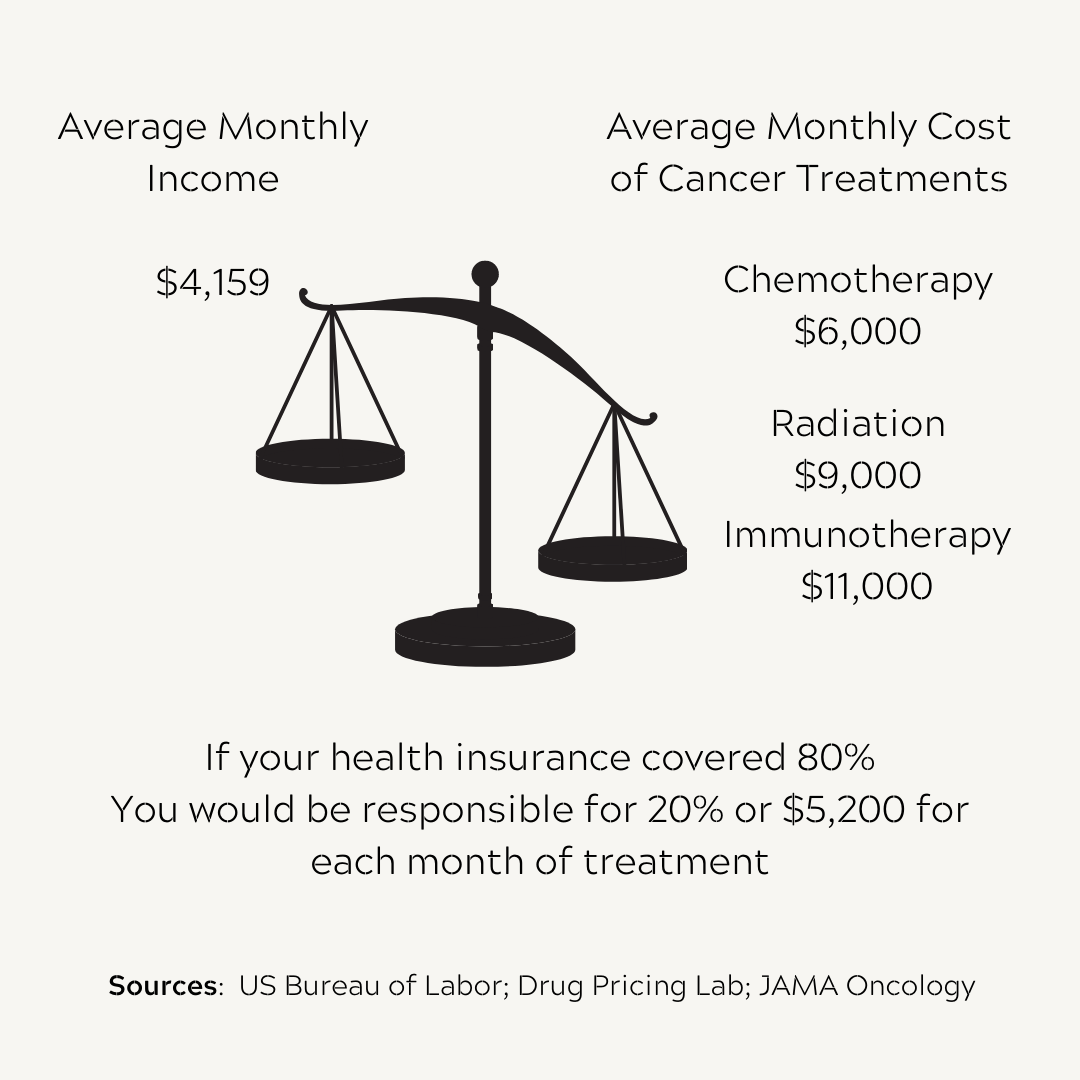

What are the financial costs of childhood cancer? Cancer is one of the most expensive medical conditions to treat. You think you have the best health insurance. But what is the financial cost when a child has cancer? Your health insurance coverage may not be what you think it is.

Costs of Childhood Cancer

Cancer is one of the most expensive medical conditions to treat. Many families face major financial challenges when their child is diagnosed with cancer. The many specialists, different tests, treatments and prescription drugs can add up very quickly. Health insurance has out-of-pocket costs. The copayments, deductibles and coinsurance payments accumulate from detection to treatment and for aftercare screenings.

Several studies have shown that cancer patients and survivors are more likely to have financial distress than are people without cancer.

Cancer affects the ability to work, and that affects the ability to pay for things like food, electricity, and housing expenses, not to mention the medical bills that keep going up. Many studies have shown that families with a child diagnosed with cancer may have to cut back on the hours they work, or leave their job completely. Both of which can affect their health insurance coverage.

Families Living in Poverty - Cancer death rates are about 20% higher among families living in the poorest U.S. counties when compared to residents of the affluent counties.

Costs of Childhood Cancer

There are several risks to having cancer and financial challenges.

- Patients may not take their medicine as directed so they can save money

- They may miss treatments due to costs

- They may not be able to meet their dietary needs

- Financial challenges can lead to bankruptcy leading to a lower quality of life

- They may experience more depression and poor mental health due to the money worries

- They may become less social

What to do about the costs of childhood cancer:

Talk. Talk to your health care providers, including your doctor if you think the costs of cancer care could be a burden. While it may feel uncomfortable at first, you can only receive help if people are aware that you need help. The more your health care team knows, the more they can be your partner in your care. They may also be able to point you to resources that may help.

Hospital social workers may be able to suggest Programs or Organizations that may help you pay for cancer treatment.

At your job, talk to your human resources department. They can answer questions about your insurance plan.

Get help understanding the medical bills. Talk to someone in the billing department, a social worker at the hospital. There are also professional services to help with bills and insurance. Patient advocates, and medical billing advocates. Although they may charge a fee, in the long run, they may be able to save you money by managing the costs of care.

For additional information of the cost of cancer, please visit cancer.gov

Disclaimer: The information in these summaries should not be used to make decisions about insurance reimbursement. More information on insurance coverage is available on Cancer.gov on the Managing Cancer Care page.

American Childrens Cancer Benevolence Fund

administered by A Warriors Mission Inc, a trusted 501(c)(3) charitable organization

Any use of this site constitutes your agreement to the Disclaimers, Terms and Conditions and Policies linked below.

Privacy Policy Terms Of Use We Do Not Discriminate Disclaimer Affiliate Program Advertise With Us

© All rights reserved. A Warriors Mission Inc. Our mission is to help meet the needs of humankind without discrimination. Our programs and services are funded entirely by private donations, foundation grants, and corporate contributions. A Warriors Mission, Inc. is a trusted 501 (c)(3) tax exempt organization. Tax Id # 84-3175352.

Gifts to the organization are tax deductible to the extent provided by law. You can be assured that we will take all reasonable measures to honor requests by the donor, but please know we retain all control and authority over all contributed funds and have the authority to redistribute those donated funds in connection with our charitable and religious purposes. This church is a qualified section 501(c)(3) organization. All tithes, offerings, or donations of any kind are tax-deductible under section 170(c)(2). Making a donation constitutes your agreement to relinquish control in accordance with IRS regulation. This authority allows us to maintain our 501(c)(3) status. IRS rules require that the fair market value of any gift received in connection with a donation must be subtracted from the amount claimed for deduction. If you believe that an error has occurred in connection with your donation, contact us

We do not warrant that the information found here is complete, reliable, useful, or otherwise accurate. Always seek the advice of your physician or other qualified health provider with any questions you may have regarding a medical condition. Never disregard professional medical advice or delay in seeking it because of something you have read on this Website. Do not rely on the information presented for medical advice or other ACCBF programs.